SOC 1 and SOC 2: What’s the Difference?

Financial and data compliance and security are essentials for every organization, and System and Organization Controls (SOC) reports are an integral part of data compliance, financial regulations, and audits. There are two types of SOC reports: SOC 1 and SOC 2.

For IT security leaders, Certified Public Accountants, and SaaS CIOs, understanding compliance standards is critical for protecting sensitive data and meeting industry requirements. SOC 1 and SOC 2 are two widely recognized audit frameworks. They are both essential components of IT compliance and data security. But what exactly are they, and how do they differ?

In this article, we take a closer look at SOC 1 and SOC 2, including the differences, and which one is right for your business.

Let's dive in . . .

What is SOC?

System and Organization Controls (SOC), refers to a series of compliance standards developed by the American Institute of Certified Public Accountants (AICPA). SOC used to stand for Service Organization Controls, but AICPA updated the standard and the overall meaning to align with more complex data security and audit standards, turning these into System and Organization Controls (SOC).

SOC reports are issued after an independent audit. They are designed to provide assurance to stakeholders, such as customers, regulators, or partners, that your organization is adhering to compliance and best practices for data security and the financial impact of third-party organizations.

Why is SOC Important for Finance and Data Security Compliance?

For IT security leaders, CPAs, and SaaS CIOs, SOC compliance serves several critical purposes:

- Building Trust: SOC reports demonstrate that your organization is taking appropriate measures to protect customer and internal data.

- Compliance with Financial Controls: If you can show this with a SOC 2 report then it puts your organization in a stronger position.

- Meeting Industry Requirements: Many industries require SOC compliance for partnerships or contracts.

- Demonstrating strong availability, security, processing integrity, confidentiality, and privacy is the purpose of a SOC 2 audit.

- Mitigating Risks: SOC frameworks identify potential vulnerabilities in financial or data security processes and systems, allowing organizations to address them proactively.

- Improving Processes: Preparing for a SOC audit often uncovers inefficiencies, leading to better overall IT governance, or financial risk management (depending on whether you're getting a SOC 1 or SOC 2 audit).

In either scenario, SOC 1 performs an important role for financial service providers, fintechs, and CPAs.

Whereas, SOC 2 is more useful for data centers, SaaS, and other cloud computing firms.

Of course, there are scenarios where a company needs both. An example would be a financial SaaS in the healthcare sector, where more compliance and enhanced security and safeguards are better than not having enough to protect data, customers, and financial security.

What is SOC 1?

SOC 1 focuses on Internal Control over Financial Reporting (ICFR) when they relate to and could be directly impacted by a third-party organization.

SOC 1 is particularly relevant for service organizations that manage financial transactions, such as:

- Financial service providers

- Fintechs

- CPAs

SOC 1 compliance reports and audits are useful for highlighting any third-party or counter-party risk associated with anything that could affect their customers' financial statements.

- Goals: Ensures that financial reporting processes are accurate, secure, and free from errors. SOC 1 audits also show your customers that their financial data is handled securely.

- Audience: Mainly useful for customers of financial service providers, financial auditors, and stakeholders responsible for financial compliance.

- Example Use Case: A payroll processing company undergoing a SOC 1 audit to assure clients of their system's reliability in financial operations. It provides peace of mind because SOC 1 guarantees compliance with the Statement on Standards for Attestation Engagements (SSAE) 18 AT-C Section 320.

For example, if you're a CPA who relies on QuickBooks for everything, how can you be sure that every system you're using is as secure, or that QuickBooks systems are SOC 1 compliant?

Intuit QuickBooks is, as you'd expect, but that's not the only piece of software that your client's financial data runs through. So how can you be sure they're equally compliant? That's the purpose of a SOC 1 audit report, as well as any subsequent changes you'll need to make to achieve compliance.

What is SOC 2?

SOC 2 evaluates an organization's controls based on the Five Trust Services Criteria (TSC). The TSC is the framework developed by the American Institute of Certified Public Accountants (AICPA).

These five criteria are:

- Security, which is mandatory

- Availability

- Confidentiality

- Processing Integrity

- Privacy

SOC 2 audits and security and compliance criteria are designed to keep sensitive data handled securely and with appropriate care.

- Goal: Focuses on operational and security controls that protect data within a system.

- Audience: Organizations and companies that need to achieve SOC 2 compliance are data centers, SaaS, and other cloud computing firms. The outcome of these reports is relevant to customers, regulators, and other stakeholders who prioritize data security.

- Example Use Case: A cloud storage provider completing a SOC 2 audit to demonstrate adherence to security and privacy standards.

If this isn't something you already have, it's something you would need if you want to gain enterprise-sized clients. SOC 2 compliance would also help you work with companies that handle protected data, such as in the financial services or healthcare sectors.

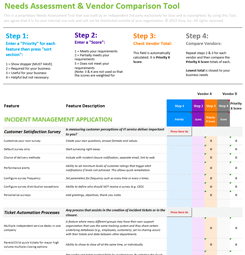

What are the Key Differences Between SOC 1 vs. SOC 2?

Let's take a closer look at the key differences between both types of SOC compliance audits.

SOC 1 |

SOC 2 |

|

Goals |

Financial security controls (ICFR) |

Data security, with some financial security and compliance overlap |

What type of company needs it? |

Financial service providers, fintech, and CPAs |

Data centers, SaaS, and cloud computing |

Who is it for? |

Customers of financial service providers, financial auditors, and stakeholders responsible for financial compliance |

Customers of the above companies, regulators, and other stakeholders |

Timescale |

A few weeks to 2 months |

3 to 12 months |

Audit Standard |

AICPA SSAE 18 AT-C Section 320 |

AICPA SSAE 18 AT-C Section 105 and 205, and the Five Trust Services Criteria (TSC) |

Pros |

Shows that financial data is being handled safely and securely |

Demonstrates strong and capable information security practices and protocols |

Cons |

Clients might still want to see proof of a SOC 2 report to demonstrate more stringent financial data security |

Takes longer and costs more money than a SOC 1 audit |

The primary distinction lies in their purpose: while SOC 1 addresses the accuracy of financial reporting, SOC 2 prioritizes the protection of data and IT systems.

It also depends on whether you need one or both reports. You may only need a SOC 1, or SOC 2 might be more suitable. It depends on your sector, business, and who your customers are.

Does Your Business Need a SOC 1 or SOC 2 Audit?

Choosing between SOC 1 and SOC 2 depends on your organization's services and industry requirements.

It also depends on what type of company you operate, what sectors you work in, and how much compliance is needed.

- You need SOC 1 if your business provides services that directly impact your clients' financial reporting. SOC 1 is mainly for financial service providers, fintechs, and CPAs.

- Choose SOC 2 if your organization handles sensitive data and your clients require proof of strong data security measures. Hence why data centers, SaaS, and cloud computing providers usually need SOC 2 audits. This is especially if you work with companies in the financial services or healthcare sectors.

For some companies, particularly those in industries like fintech, both SOC 1 and SOC 2 compliance may be necessary.

When Should Your Organization Become SOC 1 or SOC 2 Compliant?

There are a number of reasons to achieve and maintain SOC 1 or SOC 2 compliance. Let's take a closer look at these.

SOC 1 Compliance

SOC 1 compliance should be demonstrated by organizations that directly influence their customers' financial reporting. Some examples would be payroll processors, loan servicers, or financial SaaS providers (FinTechs).

This demonstrates the reliability of internal controls that oversee the movement and storage of client financial data. This gives your customers and their financial auditors and stakeholders confidence in transactional accuracy, and the figures that flow through their books.

This is even more important when a company either has private or public investors, or when the financials are connected to the service it delivers.

SOC 2 Compliance

SOC 2 is usually a must-have compliance certificate for companies that handle sensitive data. This includes cloud storage providers, SaaS companies, and managed IT services (ITSM, help desks, etc).

Achieving and maintaining SOC 2 compliance demonstrates robust security practices that are aligned with the five Trust Services Criteria (TCS).

As PwC says: "A SOC 2 report can play an important role in oversight of the organization, vendor management programs, internal corporate governance and risk management processes and regulatory oversight. SOC 2 reports are often applicable for businesses with sophisticated customer relationships and those offering digital services."

How Does Having SOC 1 or SOC 2 Affect Stakeholders?

Although getting either or both SOC 1 or SOC 2 audits done, their primary purpose is to reassure your customers and stakeholders.

If an enterprise company is picking between two IT Service Management (ITSM) companies, and one has SOC 1 and 2 and the other doesn't, there's a good chance they'll go with the one that's SOC compliant.

SOC 1 Stakeholders

The primary audience for SOC 1 reports includes clients' auditors and internal finance teams, who use these reports to verify financial reporting integrity. It reassures stakeholders that their financial data is accurately managed.

SOC 2 Stakeholders

SOC 2 reports cater to a wider variety of stakeholders, including customers, regulators, and prospective partners. These reports, often shared under NDA, help assure stakeholders of a company's ability to safeguard sensitive data and meet operational commitments.

If you don't have either, but need one or both to complete a large deal, then it's definitely worth investing in either of them. That's the difference SOC makes to stakeholders.

How Can Software Help with SOC?

Achieving and maintaining SOC compliance can be a complex process, but specialized software can simplify it. Here are four ways software can make SOC compliance easier to achieve and maintain:

- Automated Monitoring and Reporting: SOC compliance tools monitor your systems for security vulnerabilities and generate audit-ready reports.

- Document Management: Centralized SaaS platforms allow teams to store and track the documentation needed for SOC audits.

- Risk Assessment: Tools identify gaps in your current controls, enabling quicker remediation before audits.

- Collaboration: Compliance software facilitates collaboration across IT, security, and audit teams to ensure all requirements are met.

Make sure, if you're aiming to achieve and maintain SOC 1 or 2 compliance, that the software you use is also compliant with the relevant or both SOC reports.

This is especially important if the use of software to maintain SOC needs to be included in any SOC compliance reports. Double-check before you subscribe that the software you're using is compliant with SOC and any other relevant industry, security, or data protection standards.

Making SOC Compliance Easier with Software

Modern compliance software can dramatically simplify the journey to SOC 1 or SOC 2 attestation. Different SaaS tools and platforms can automate everything from policy management to evidence collection, and security monitoring.

With the right tech tools, this reduces manual effort, accelerates audit readiness, and makes sure you have real-time insights into compliance statuses. This software also supports integration with cloud applications, maintaining continuous compliance and reducing risks.

3 Misconceptions about SOC Reports

There are a few things people often get wrong when thinking about SOC compliance.

-

SOC 1 and SOC 2 Do Similar Things

Although they originate from the same organization, their scopes differ significantly. SOC 1 focuses on financial reporting. SOC 2 emphasizes non-financial data security and operational integrity.

-

Every IT Company, SaaS, Cloud, or ITSM Needs SOC 2

SOC 2 is not universally required but is often requested by larger enterprise clients or customers handling sensitive information. It's a strategic investment for companies prioritizing security and trust. It's also very much needed in the healthcare and financial services sectors.

-

SOC Compliance Only Needs to Happen Once

Both SOC 1 and SOC 2 require ongoing monitoring and periodic audits to maintain compliance. Type 1 audits provide a snapshot of controls at a specific time, while Type 2 audits assess their effectiveness over a longer period. You can't just do them once and forget about it.

Key Takeaways: SOC 1 and SOC 2: Choosing Your Level of Security

For IT security leaders, Certified Public Accountants, and SaaS CIOs, navigating the complex landscape of compliance, SOC 1 and SOC 2 are hard to avoid.

Understanding the distinctions between SOC 1 and SOC 2 is the first step toward securing organizational trust and data integrity. With the right approach and tools, achieving SOC compliance can become a strategic advantage.

The good news is, alongside dozens of other security compliance certificates, Giva's software is SOC 2 compliant:

Giva's SSAE 18 SOC 2 Type 2 Compliance

Giva's data center partner, DataBank, undergoes an SSAE 18 SOC 2 Type 2 annual audit with an independent third party, and they continue to monitor Giva's internal measures and controls against SOC 2 standards.

As a result, Giva has the appropriate controls in place to minimize risks related to security, privacy, processing, availability, and confidentiality.

Preventing cyber security breaches and safeguarding data is critically important to Giva customers, especially those with significant regulatory requirements and financial penalties.

DataBank performs a rigorous SSAE-18 audit annually in each of its data centers. It includes the data center's system controls, design, and operating effectiveness over a one-year period.

Giva's help desk and ITSM software include knowledge management and a self-service portal, which can help you bring tier 0 support to your support organizations.

To learn more, book a free Giva demo to see our solutions in action, or start your own free, 30-day trial today!